How to Thrive as a Real Estate Investor in

Santa Ana, CA

Why Invest in

Santa Ana, CA

Santa Ana, the county seat of Orange County, boasts a diverse economy anchored by government services, education, healthcare, and a burgeoning tech sector. Its strategic location near major highways and proximity to Los Angeles make it a hub for commerce and logistics. The city's rich cultural heritage, combined with ongoing revitalization efforts, attracts both residents and businesses. With a growing population and a commitment to urban development, Santa Ana presents promising opportunities for real estate investors.

Real Estate Investment Trends in

Santa Ana, CA

With a diverse economy, a booming job market, and affordable housing options,

Santa Ana, CA

provides a solid foundation for long-term growth. Its revitalized downtown, expanding cultural scene, and strong rental demand make it a prime location for both residential and commercial investments. Here’s why

Santa Ana, CA

is a standout market:

Key Neighborhoods to Watch:

Downtown Santa Ana: This historic district is undergoing significant revitalization, blending vintage charm with modern amenities. The area's art scene, trendy eateries, and cultural events attract young professionals and creatives.

Floral Park: Known for its tree-lined streets and vintage homes, Floral Park offers a suburban feel within the city. Its strong community association and preservation efforts maintain property values and neighborhood appeal.

French Park: As one of Santa Ana's oldest neighborhoods, French Park features a mix of architectural styles and is close to downtown. The area's walkability and historic significance make it attractive to renters and buyers seeking character-rich properties.

Metro Classic: Located near major freeways and shopping centers, Metro Classic offers convenience and accessibility. The neighborhood's mix of single-family homes and apartments caters to a diverse tenant base.

Forecast and Analysis:

Santa Ana, CA

Based on the unique characteristics of the

Santa Ana, CA

real estate market, the following forecasts and analyses emerge:

Steady Appreciation:

Despite minor monthly fluctuations, Santa Ana's housing market has shown consistent year-over-year growth, indicating long-term value appreciation.

Rental Demand:

With a median rent of $2,095, the city maintains a strong rental market, appealing to investors seeking steady income streams.

Urban Development:

Ongoing infrastructure projects and urban renewal initiatives are enhancing neighborhood appeal and boosting property values.

Economic Resilience:

Santa Ana's diversified economy and strategic location contribute to its ability to weather economic downturns, supporting a stable real estate market.

Strategies for Conquering

Santa Ana, CA

To fully leverage the potential of this city's real estate market, consider these unique tactics:

Target Historic Neighborhoods:

Investing in areas like Floral Park and French Park can yield long-term appreciation due to their unique charm and community efforts to preserve neighborhood character.

Leverage Rental Properties:

Given the strong rental demand, acquiring multi-family units or properties suitable for leasing can provide consistent cash flow.

Monitor Urban Development:

Staying informed about city planning and development projects can help identify emerging neighborhoods with growth potential.

Engage with Local Communities:

Building relationships with neighborhood associations can provide insights into community needs and enhance property management strategies.

Diversify Property Types:

Considering a mix of single-family homes, condos, and apartments can spread risk and tap into different market segments.

Other Opportunities in

California

Apart from

Santa Ana, CA

, there are other investment opportunities in

California

worth considering:

- Growing Economy: Chula Vista's development projects and proximity to San Diego make it an emerging hotspot for investors seeking growth opportunities.

- Affordable Entry Point: Compared to other Southern California cities, Chula Vista offers more affordable property prices, attracting first-time investors.

- Strong Job Market: Irvine's robust economy, driven by tech and education sectors, ensures a steady influx of professionals seeking housing.

- High Property Values: The city's desirable location and amenities contribute to high property values and potential for appreciation.

- Educational Hub: Home to several universities, Riverside has a steady demand for rental properties catering to students and faculty.

- Infrastructure Development: Ongoing infrastructure projects are enhancing connectivity and boosting the city's real estate appeal.

- High Rental Yields: Stockton offers some of the highest rental yields in California, making it attractive for cash flow-focused investors.

- Economic Diversification: Efforts to diversify the local economy are improving job prospects and supporting housing demand.

Rentastic Verdict

Santa Ana presents a compelling opportunity for real estate investors seeking a blend of cultural richness, economic stability, and urban growth. Its diverse neighborhoods, strong rental market, and strategic location within Orange County make it a standout choice. While property values are on the rise, the city's ongoing development projects and community initiatives suggest sustained appreciation. Investors who engage with local communities and stay attuned to market trends can capitalize on Santa Ana's dynamic real estate landscape.

Empowering Investors in

Santa Ana, CA

Rentastic equips real estate investors with powerful tools designed to streamline decision-making and maximize returns in this City's competitive market.

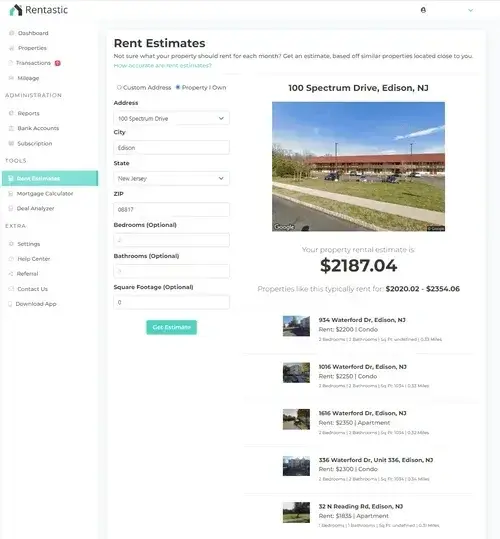

Rent Estimator

The Rent Estimator tool equips investors with valuable insights into the rental market. By analyzing market data and property-specific factors, it accurately estimates the potential rental income of a property. This tool enables investors to set competitive rental rates, project cash flows, and evaluate the profitability of their investments.

Learn More

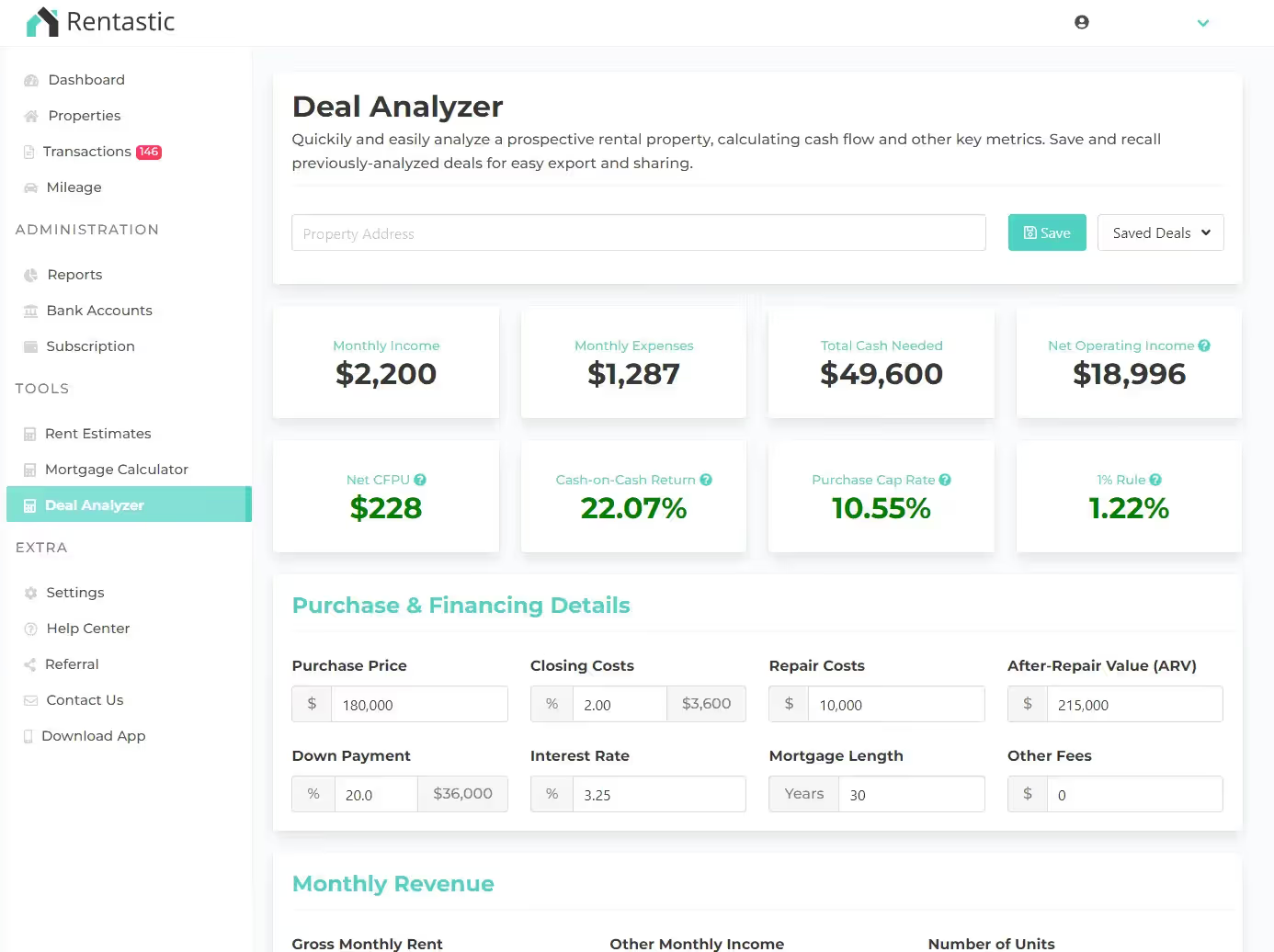

Deal Analyzer

With the Deal Analyzer tool, investors can perform comprehensive financial analyses of potential real estate deals. By inputting essential financial information such as purchase price, rental income, expenses, and financing details, investors gain a deeper understanding of the investment’s profitability. This tool assists in identifying lucrative opportunities and mitigating risks by providing reliable calculations and insights.

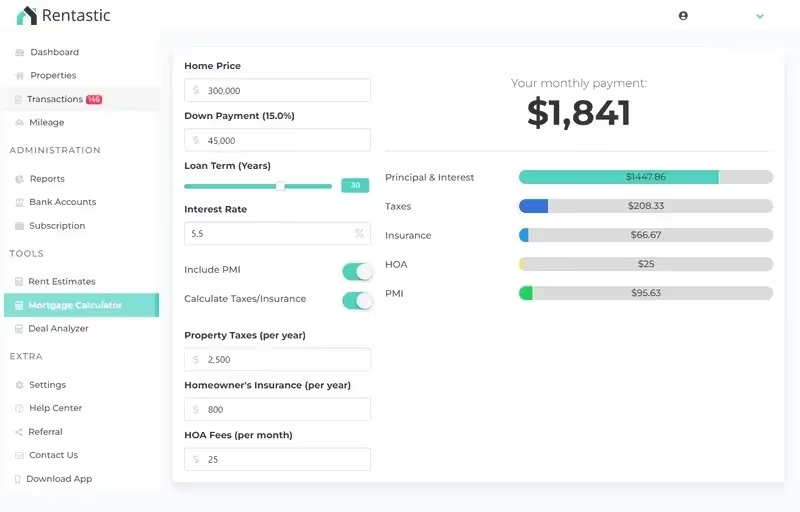

Learn MoreMortgage Calculator

Rentastic’s Mortgage Calculator offers investors the ability to estimate monthly mortgage payments based on loan parameters, interest rates, and loan terms. This tool helps investors evaluate different financing options, determine affordability, and understand the impact of financing on their investment’s cash flow. By making informed decisions about mortgage options, investors can optimize their financial strategies.

Learn More

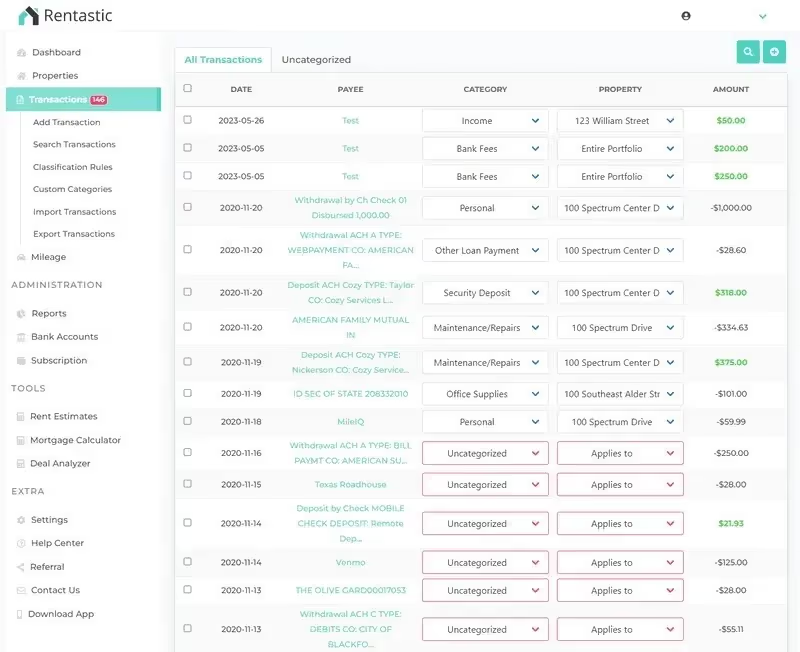

Expense Tracking

Successful real estate investing requires efficient expense management, and Rentastic’s Expense Tracking tool simplifies this process. It allows investors to track and monitor property-related expenses, such as maintenance, repairs, insurance, and property management fees. By maintaining accurate records and gaining visibility into their expenses, investors can effectively budget, analyze profitability, and make informed financial decisions.

Learn MoreRentastic equips you with all the tools you need to succeed in this City's competitive real estate market. From rental income estimation to financial deal analysis and expense tracking, our platform empowers you to make informed decisions and achieve sustainable investment growth.